|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

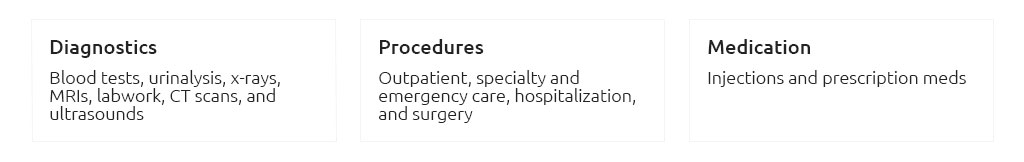

Understanding Cat Medical Insurance: A Comprehensive Guide for Pet OwnersWhen you first bring a feline friend into your home, the overwhelming joy and companionship they offer often overshadow the practical considerations of pet ownership. However, as any seasoned pet owner will attest, the health and well-being of your cat can quickly become one of your top priorities, leading to the inevitable question: Should you invest in cat medical insurance? This guide aims to unravel the complexities surrounding pet insurance, helping you make an informed decision that benefits both you and your beloved pet. Why Consider Cat Medical Insurance? Cats, with their agile grace and curious nature, are known to lead adventurous lives. While this is part of their charm, it also means they are prone to accidents and illnesses that could potentially lead to hefty veterinary bills. Herein lies the primary appeal of cat medical insurance: financial peace of mind. By paying a modest monthly premium, you can safeguard yourself against unexpected expenses and ensure your cat receives the best possible care without financial constraints. It’s akin to purchasing peace of mind, allowing you to focus on nurturing your pet’s health without the constant worry of looming expenses. Understanding the Coverage Cat medical insurance plans vary significantly, offering different levels of coverage that can include everything from routine check-ups to surgeries and chronic condition management.

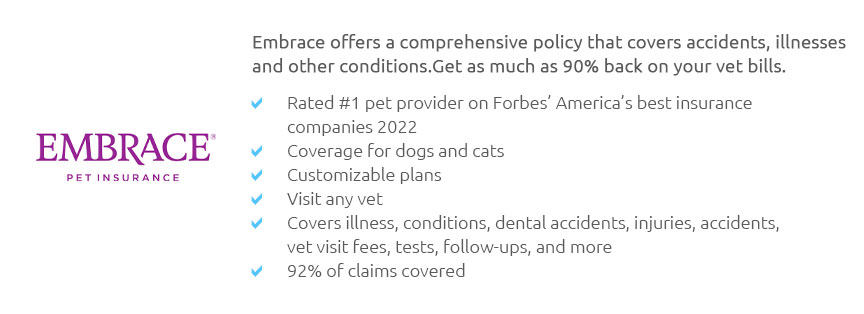

The Cost Factor Much like human health insurance, the cost of cat medical insurance can vary based on several factors, including the cat’s age, breed, and pre-existing conditions. Younger, healthier cats typically come with lower premiums, while older cats or those with known health issues might incur higher costs. It’s crucial to weigh these expenses against potential future vet bills, understanding that while monthly premiums can add up, they often pale in comparison to the cost of unexpected surgeries or long-term treatments. Choosing the Right Provider With a plethora of insurance companies now catering specifically to pet owners, selecting the right provider is a task that requires thorough research. Look for companies with a solid reputation, positive customer reviews, and transparent policy details. Some providers even offer customizable plans, allowing you to tailor coverage to your specific needs. Don’t shy away from asking questions or seeking recommendations from fellow pet owners or your veterinarian, as firsthand experiences can offer invaluable insights. Final Thoughts Investing in cat medical insurance is a personal decision, one that requires careful consideration of your financial situation, your cat’s health history, and your peace of mind. While some may view it as an unnecessary expense, others find it an invaluable tool in ensuring their pet’s health and longevity. Ultimately, it’s about creating a safety net that allows you to enjoy the companionship of your cat, knowing that you’re prepared for whatever health challenges may arise. Whether you decide to go for a comprehensive plan or opt for basic coverage, the key is making an informed choice that aligns with your values and circumstances. https://www.healthypawspetinsurance.com/cat-and-kitten-insurance

medical care. Kittens to five-year-old cats. Kittens and younger cats can get ... https://www.petmd.com/cat/general-health/insurance-cats

For many pet parents, knowing their cat is insured in the event of a health problem makes pet insurance a good purchase, no matter how often ... https://www.petsbest.com/cat-insurance

Pets Best offers cat health insurance plans for accidents, illnesses, and more! Learn more about our affordable insurance plan options for your feline ...

|